Microfinance and Self Help Groups

Self Help Groups (SHGs) of women had proved to be extremely efficient in returning loans promptly.

After Mr Mohammad Yunus from Bangladesh received Nobel Peace Prize in 2006 for founding the Grameen Bank and pioneering the concepts of microcredit and microfinance, companies started investing in microfinance. Loans were offered at doorsteps without asking for any security, unlike national banks that provided loans only for land owners and regular employees. The catch was that the interest rates were very high. It became a vicious cycle as these companies went from home to home enticing people, especially gullible women to take easy loans. Families fell into debts, stopped taking up MGNREGA work as the payment was not on weekly basis, started working two wages a day, children started skipping schools to work as labourers. People literally resorted to begging as their income was not sufficient for returning loans. Women absconding and men committing suicides became a regular news in these villages.

Suvarna and Mahananda of Jagruti, observed lack of women participation in meetings and reduced job demands at MGNREGA. They took up case studies to understand how deep rooted the problem was. It was a clear case of exploitation of villagers', especially women's vulnerabilities by the microfinance companies.

Jagruti started organising women against the violence indulged on them by microfinance companies. A study was done on how much each family was into the debt and what was the way out. About 850 women (families) from 10 villages were studied. Jagruta Mahila Okkoota decided to organise these women back into SHGs as it was done before, in order for better communication among loan takers, to encourage people to plan their returns and work on their finances in a better way. About 67 SHGs have been formed till date.

Memorandum submitted to Shri Krishnabhaire Gowda for proper regulations to be imposed on the workings of microfinance companies .

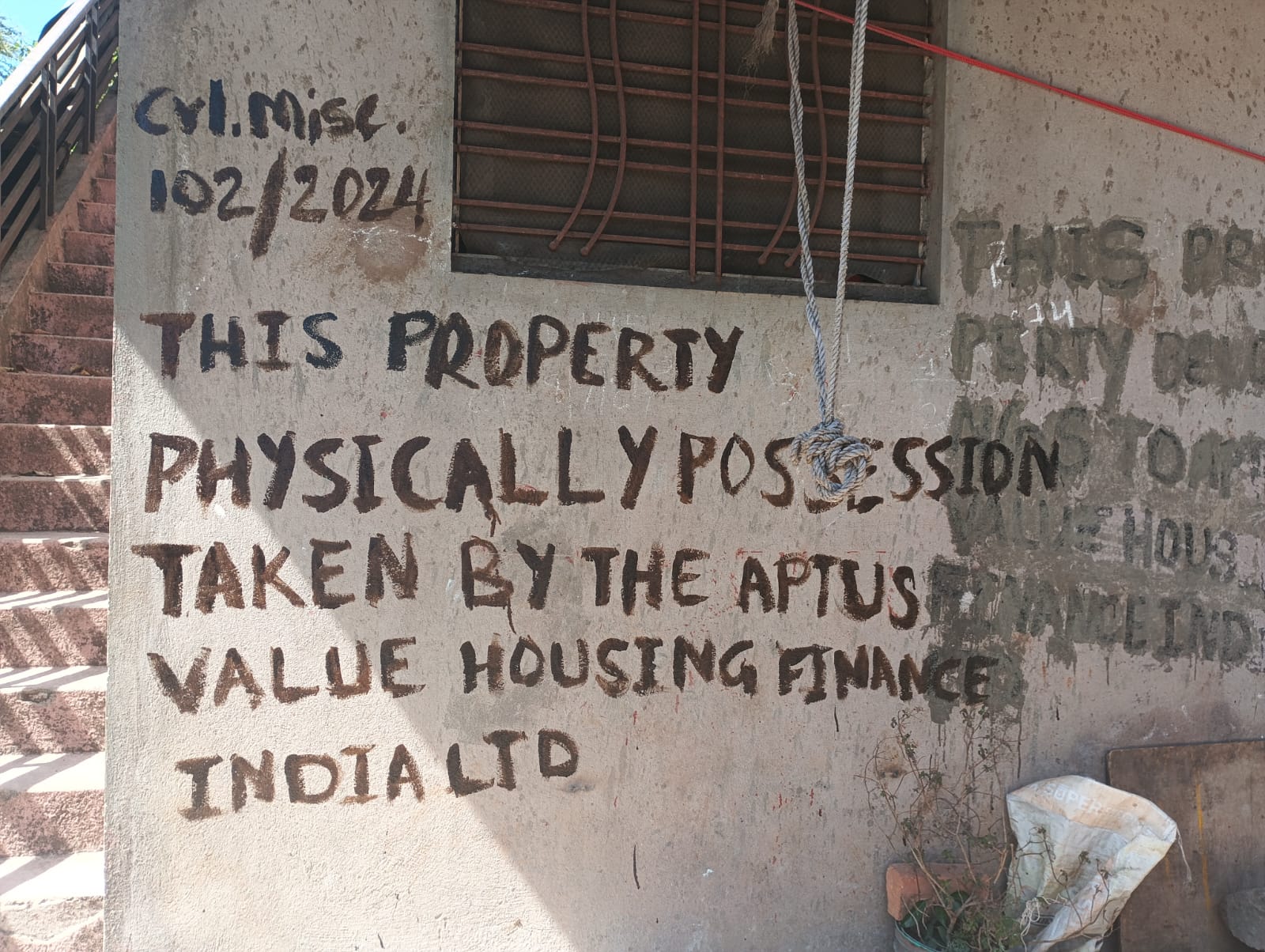

A notice on a house that has been seized by a microfinance company.

Sharada from Jagruti sharing about the survey on microfinance violence in national level workshop on farmer suicides.